Excel Payback Period: Understanding the Basics and Its Importance

As a business owner or financial analyst, it is crucial to understand the concept of payback period. Payback period is the amount of time it takes for a project or investment to recover its initial cost. It is an essential tool in evaluating the feasibility of a project or investment, and Excel provides a simple and efficient way to calculate payback period. In this article, we will discuss the basics of Excel payback period and its importance in financial analysis.

What is Excel Payback Period?

Excel payback period is a financial metric that measures the length of time it takes for an investment to recoup its initial cost. It is calculated by dividing the initial investment by the annual cash inflows generated by the investment. The result is the number of years it takes for the investment to pay for itself.

Excel provides a straightforward way to calculate payback period using the built-in function “=PAYBACK.” This function takes two arguments: the initial investment and the cash flows generated by the investment. The function returns the payback period in years and fractions of a year.

Calculating Excel Payback Period

To calculate payback period in Excel, follow these steps:

1. Enter the initial investment in cell A1.

2. Enter the annual cash inflows in cells A2 through A(n+1), where n is the number of years.

3. In cell B1, enter the formula “=PAYBACK(A1,A2:A(n+1))”.

4. Press Enter to calculate the payback period.

The result will be displayed in cell B1 as the number of years and fractions of a year it takes for the investment to pay for itself.

The Importance of Excel Payback Period

Payback period is an essential tool in evaluating the feasibility of a project or investment. It provides a simple and easy-to-understand metric for determining how long it will take for an investment to recoup its initial cost. This information is crucial in making informed financial decisions.

Excel payback period is particularly useful in comparing different investment opportunities. By calculating the payback period for each investment, you can determine which investment will generate cash flows sooner and therefore be more attractive.

Payback period is also useful in assessing risk. Investments with shorter payback periods are generally considered less risky because they generate cash flows sooner and are less susceptible to changes in the market or economy.

Limitations of Excel Payback Period

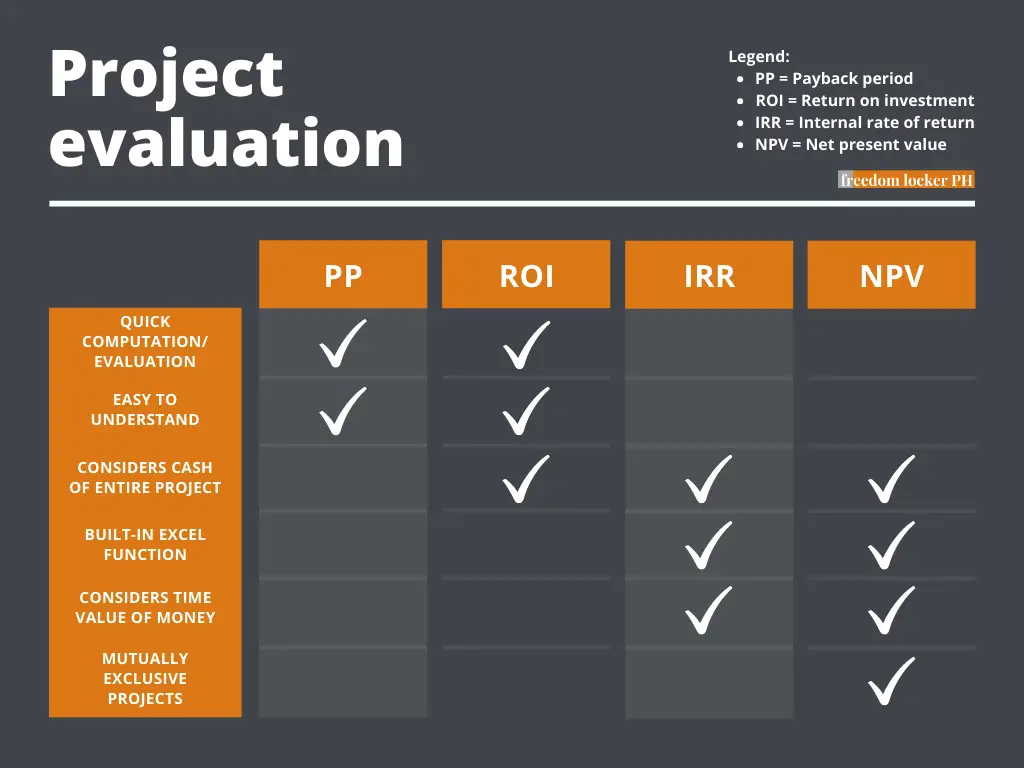

While payback period is a useful tool in financial analysis, it has some limitations. One limitation is that it does not take into account the time value of money. Cash flows generated in the future are worth less than cash flows generated today due to inflation and the opportunity cost of tying up capital.

Another limitation is that payback period does not consider cash flows generated after the initial investment has been recouped. This can lead to a biased view of the investment’s profitability, as it ignores the potential for long-term cash flows.

Conclusion

Excel payback period is a simple and efficient way to calculate the length of time it takes for an investment to recoup its initial cost. It is an essential tool in evaluating the feasibility of a project or investment and comparing different investment opportunities. However, it has some limitations, such as not taking into account the time value of money and ignoring long-term cash flows. As such, it should be used in conjunction with other financial metrics to make informed financial decisions.