The Ascension of AMD Stock: A Deep Dive into Advanced Micro Devices’ Phenomenal Rise

In the fast-paced realm of technology, Advanced Micro Devices, Inc. (AMD) has emerged as a formidable player, orchestrating a remarkable ascent in the stock market. As of the latest reports, AMD stock has witnessed a meteoric rise, captivating investors and enthusiasts alike. This article delves into the various factors contributing to AMD’s success story, the challenges faced, and what the future may hold for this semiconductor giant.

The Genesis of AMD:

Founded in 1969 by Jerry Sanders and seven co-founders, AMD initially focused on producing microprocessors and semiconductor devices. In the early years, the company faced stiff competition from industry juggernaut Intel. However, AMD’s commitment to innovation and resilience in the face of challenges laid the foundation for its eventual breakthrough.

Key Milestones:

AMD’s journey is marked by several significant milestones that have contributed to its current standing. One such pivotal moment was the launch of the AMD K6 processor in 1997, challenging Intel’s dominance in the x86 microprocessor market. Over the years, AMD continued to introduce cutting-edge products, including the Athlon and Opteron processors, gaining traction among both consumers and enterprise clients.

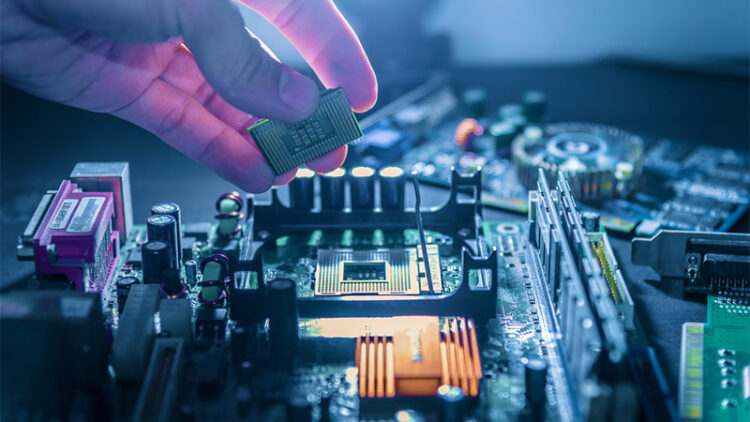

The Acquisition of ATI Technologies:

In a strategic move to diversify its product portfolio, AMD acquired ATI Technologies in 2006, integrating graphics processing units (GPUs) into its lineup. This move allowed AMD to offer a comprehensive solution for both CPU and GPU needs, enhancing its competitiveness in the market.

The Zen Architecture Revolution:

One of the most significant turning points for AMD was the introduction of the Zen architecture. Launched in 2017, the Ryzen series of processors based on Zen architecture garnered widespread acclaim for their performance and value. The Zen architecture played a pivotal role in closing the performance gap with Intel, positioning AMD as a serious contender in the CPU market.

Epic Success in the Data Center:

AMD’s EPYC server processors, also based on the Zen architecture, have enjoyed considerable success in the data center segment. Major cloud service providers, including Amazon Web Services and Microsoft Azure, have adopted EPYC processors, further solidifying AMD’s position in the enterprise market.

Radeon Graphics Dominance:

In the realm of graphics, AMD’s Radeon GPUs have gained ground against competitors like NVIDIA. The release of the RDNA architecture marked a leap forward in graphics performance, attracting gamers and content creators alike. The successful launch of the Radeon RX 6000 series GPUs further bolstered AMD’s position in the high-performance graphics market.

Strategic Partnerships and Collaborations:

AMD’s success is not solely attributed to its product lineup but also to its strategic partnerships. Collaborations with major technology companies, such as Microsoft and Sony, have propelled AMD to the forefront of the gaming industry. AMD’s processors and GPUs power the gaming consoles Xbox Series X and PlayStation 5, underscoring the company’s significance in the gaming ecosystem.

Market Performance and Stock Surge:

As of the latest market data, AMD’s stock has experienced a remarkable surge, outperforming market expectations. The stock’s growth has been fueled by strong financial results, increasing market share, and optimistic forecasts. Investors have shown confidence in AMD’s ability to innovate and compete effectively in the rapidly evolving semiconductor landscape.

Challenges Faced:

Despite its impressive achievements, AMD has faced its share of challenges. The semiconductor industry is inherently cyclical, with factors like global economic conditions and supply chain disruptions impacting companies. AMD, like its competitors, has grappled with the ongoing semiconductor shortage, leading to supply chain constraints and increased demand for its products.

Competition and Market Dynamics:

The semiconductor industry is intensely competitive, with players like Intel, NVIDIA, and Qualcomm vying for market share. While AMD has made significant strides, it must navigate a landscape where technological advancements and market dynamics can shift rapidly. Vigilance and adaptability will be crucial for sustaining its current momentum.

Future Outlook:

Looking ahead, AMD’s future appears promising, buoyed by its strong product portfolio and growing market presence. The increasing demand for high-performance computing, fueled by trends like artificial intelligence, data analytics, and 5G, positions AMD to capitalize on emerging opportunities.

The ongoing evolution of semiconductor technology, including the transition to smaller manufacturing nodes, will be a critical factor in determining AMD’s competitiveness. Additionally, continued innovation in areas such as AI, machine learning, and immersive computing will play a pivotal role in shaping AMD’s trajectory.

Conclusion:

In conclusion, AMD’s remarkable journey from a challenger in the semiconductor industry to a dominant force in CPUs and GPUs exemplifies the company’s resilience and commitment to innovation. The strategic decisions, technological breakthroughs, and market successes have collectively propelled AMD’s stock to new heights. As the semiconductor landscape continues to evolve, AMD’s ability to navigate challenges and seize emerging opportunities will be key to its sustained success in the dynamic world of technology.

- hat is AMD, and what does it stand for?

- AMD stands for Advanced Micro Devices, Inc. It is a multinational semiconductor company known for designing and manufacturing microprocessors, GPUs, and other computing technologies.

- How has AMD’s stock performance been in recent years?

- AMD’s stock performance has been impressive in recent years, experiencing significant growth. The company has gained market share in both the CPU and GPU markets, contributing to its positive stock trajectory.

- What factors have contributed to AMD’s stock growth?

- Several factors have contributed to AMD’s stock growth, including successful product launches like the Ryzen and EPYC processors, strategic partnerships, advancements in technology, and increased market share in various segments.

- How does AMD compare to its main competitors in the semiconductor industry?

- AMD competes with major players like Intel and NVIDIA in the semiconductor industry. The company has made notable strides in narrowing the performance gap with Intel and gaining traction in both CPU and GPU markets.

- What challenges has AMD faced in recent times?

- Like many semiconductor companies, AMD has faced challenges related to the global semiconductor shortage, impacting its supply chain and production capabilities. Understanding how the company addresses these challenges is crucial for investors.

- What is the significance of AMD’s product lineup, including Ryzen and Radeon?

- AMD’s product lineup, featuring the Ryzen series of processors and Radeon GPUs, has been instrumental in the company’s success. These products have gained recognition for their performance, value, and competitiveness in the market.

- How does AMD’s stock valuation compare to industry standards?

- Investors often assess a company’s stock valuation concerning industry standards and peers. Understanding factors like price-to-earnings ratio (P/E ratio) and other valuation metrics can provide insights into the stock’s perceived value.

- What role does AMD play in the gaming industry, and how does it impact its stock?

- AMD is a significant player in the gaming industry, providing processors and GPUs for gaming consoles like Xbox and PlayStation. The success of gaming-related products can have a direct impact on AMD’s stock performance.

- What is AMD’s strategy for future growth, and how does it plan to stay competitive?

- Investors are often interested in a company’s long-term strategy. Understanding AMD’s plans for future growth, including research and development initiatives, strategic partnerships, and market expansion, is crucial for assessing its potential.

- What are analysts’ projections for AMD’s future performance?

- Analysts’ forecasts and recommendations can provide valuable insights for investors. Understanding the consensus among analysts regarding AMD’s future performance can help investors make informed decisions.

Remember, investing in stocks involves risks, and it’s advisable to conduct thorough research or consult with a financial advisor before making any investment decisions.